The Single Strategy To Use For Medicare Graham

The Single Strategy To Use For Medicare Graham

Blog Article

Getting My Medicare Graham To Work

Table of ContentsThe Ultimate Guide To Medicare GrahamMedicare Graham Fundamentals ExplainedThe smart Trick of Medicare Graham That Nobody is Talking AboutThe Ultimate Guide To Medicare GrahamThe smart Trick of Medicare Graham That Nobody is Talking About3 Easy Facts About Medicare Graham DescribedMedicare Graham Fundamentals ExplainedFacts About Medicare Graham Revealed

In 2024, this threshold was set at $5,030. As soon as you and your plan spend that quantity on Part D medications, you have actually gone into the donut opening and will certainly pay 25% for medicines going ahead. As soon as your out-of-pocket costs reach the 2nd limit of $8,000 in 2024, you are out of the donut hole, and "tragic coverage" begins.In 2025, the donut hole will certainly be greatly removed in support of a $2,000 restriction on out-of-pocket Part D drug costs. Once you strike that threshold, you'll pay absolutely nothing else out of pocket for the year.

While Medicare Part C works as a choice to your original Medicare plan, Medigap collaborates with Parts A and B and assists fill out any type of protection gaps. There are a couple of important points to find out about Medigap. Initially, you need to have Medicare Components A and B prior to buying a Medigap policy, as it is a supplement to Medicare and not a stand-alone policy.

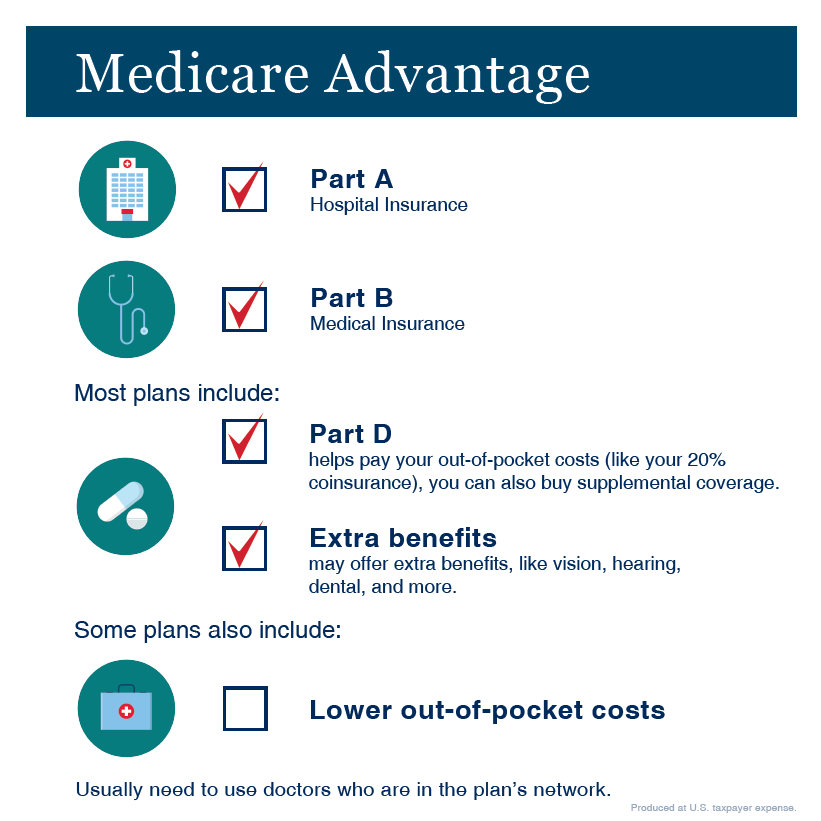

Medicare has actually advanced over the years and now has four components. If you're age 65 or older and receive Social Protection, you'll immediately be signed up partially A, which covers hospitalization costs. Components B (outpatient services) and D (prescription medication advantages) are voluntary, though under specific situations you might be instantly registered in either or both of these as well.

The Definitive Guide for Medicare Graham

This article explains the kinds of Medicare prepares readily available and their coverage. It likewise uses advice for individuals that care for member of the family with disabilities or wellness conditions and wish to handle their Medicare affairs. Medicare includes 4 parts.Medicare Part A covers inpatient hospital care. It also includes hospice care, knowledgeable nursing facility care, and home medical care when a person meets specific requirements. Monthly premiums for those who require to.

buy Part A are either$285 or$ 518, depending on the number of years they or their spouse have paid Medicare taxes. This optional protection needs a regular monthly costs. Medicare Part B covers clinically essential solutions such as outpatient doctor visits, analysis services , and preventive solutions. Personal insurance providers sell and carry out these policies, yet Medicare must approve any type of Medicare Benefit strategy before insurance firms can market it. These strategies supply the same coverage as components A and B, yet lots of additionally consist of prescription medication insurance coverage. Regular monthly premiums for Medicare Benefit prepares have a tendency to rely on the area and the strategy an individual chooses. A Component D plan's insurance coverage depends on its price, medication formulary, and the insurance policy supplier. Medicare does not.

The Buzz on Medicare Graham

typically cover 100 %of clinical costs, and the majority of plans need an individual to satisfy an insurance deductible prior to Medicare spends for clinical solutions. Component D usually has an income-adjusted costs, with greater costs for those in higher revenue braces. This relates to both in-network and out-of-network health care experts. Nonetheless, out-of-network.

care incurs added expenses. Medicare Near Me. For this type of plan, managers establish what the insurer spends for medical professional and healthcare facility protection and what the strategy owner should pay. A person does not require to pick a primary treatment physician or get a recommendation to see a specialist.

The costs and benefits of different Medigap plans depend on the insurance policy company. When a person starts the plan, the insurance policy company aspects their age right into the premium.

Some Ideas on Medicare Graham You Need To Know

The insurance company bases the initial premium on the person's current age, however costs climb as time passes. The price of Medigap plans varies by state. As kept in mind, rates are reduced when a person gets a policy as quickly as they get to the age of Medicare qualification. Specific insurance companies may additionally supply price cuts.

Those with a page Medicare Advantage plan are disqualified for Medigap insurance policy. The time might come when a Medicare strategy holder can no more make their very own decisions for reasons of psychological or physical wellness. Before that time, the person must designate a relied on individual to serve as their power of lawyer.

The individual with power of lawyer can pay expenses, file taxes, gather Social Security benefits, and pick or alter health care plans on part of the guaranteed person.

Medicare Graham Fundamentals Explained

A release form alerts Medicare that the guaranteed individual permits the called person or team to access their medical information. Caregiving is a requiring job, and caretakers typically invest much of their time meeting the demands of the person they are caring for. Some programs are readily available to provide (Medicare) financial support to caretakers.

military professionals or people on Medicaid, other choices are readily available. Every state, along with the Area of Columbia, has programs that permit qualifying Medicaid recipients to manage their long-lasting care. Depending upon the individual state's policies, this may consist of working with about provide care. Since each state's regulations vary, those looking for caregiving settlement have to look right into their state's needs.

The Best Strategy To Use For Medicare Graham

The rate of Medigap plans varies by state. As kept in mind, rates are reduced when a person purchases a policy as soon as they get to the age of Medicare qualification.

Those with a Medicare Benefit strategy are ineligible for Medigap insurance coverage. The time might come when a Medicare strategy owner can no longer make their own choices for factors of mental or physical health. Before that time, the individual needs to assign a trusted person to work as their power of lawyer.

The Best Guide To Medicare Graham

A power of lawyer paper allows one more individual to perform company and make choices in behalf of the guaranteed person. The individual with power of lawyer can pay expenses, documents taxes, gather Social Safety and security advantages, and select or transform healthcare strategies on behalf of the guaranteed person. An option is to call someone as a health care proxy.

A launch form informs Medicare that the guaranteed individual allows the named person or group to access their medical info. Caregiving is a requiring task, and caregivers frequently spend much of their time satisfying the demands of the person they are taking care of. Some programs are offered to give monetary assistance to caretakers.

Report this page